Introduction

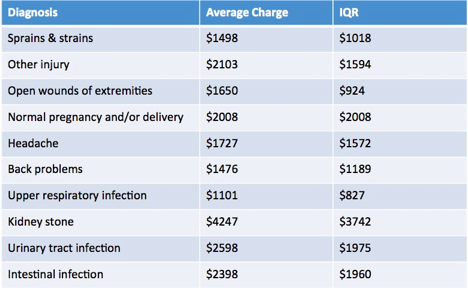

Do you have health insurance? Even if you do, do you still feel like you pay a lot for your medical expenses? Here’s the point: do you know what the #1 cost of personal bankruptcy is in the U.S.? Medical bills. Want to know a very easy way to rack up huge bills? That would be using the emergency room as your source of care. The average cost of a visit to the ER for over 8,000 patients across the U.S. was $2,168, according to a recent study funded by the National Institute of Health. Look at these average costs (the interquartile range (IQR) represents the difference between the 25th and 75th percentile of charges, looking at the wide discrepancy in charges).

Can you afford this without insurance (or even with insurance, given your co-pays and deductibles)? This Straight, No Chaser post is the first of your empowerment series. Remember, health empowerment starts with knowledge. Remember it’s the above types of charges that you’re trying to avoid.

Did you know that according to the Census Bureau, there are still about 27.5 Americans without health insurance as of 2018 (that number was estimated to be as high as 50 million prior to the implementation of the Affordable Care Act, aka Obamacare)? 2018 was also the first year since 2008-09 for which there was an increase in this number. Draw your own inferences about why this is the case (or just look at the below picture!).

Insurance Options

Where do you start if you don’t have insurance? What should you do if you have insurance? What if it’s an emergency? Let’s go through a series of options you have available to you that you may not know how to enlist.

How do you choose affordable insurance coverage if you don’t have a job, your job doesn’t provide health benefits, or if you just don’t have enough money to afford it? Work through the following steps.

- Look For Coverage Through Your Spouse or Domestic Partner. If you have a spouse or partner, there’s money to be saved by piggybacking off the other’s coverage. Explore this option before accepting a new plan that requires you to pay more.

- Explore the Health Care Marketplace as Your First Stop. This is especially the case if you’re otherwise uncovered or are an entrepreneur or small business owner. It’s also especially applicable if you have a pre-existing medical condition. Go to healthcaregov.org for details.

- Medicaid: In more than half the US, state Medicaid expansion accompanied the Affordable Care Act. This has resulted in the number of people qualified to receive Medicaid increasing dramatically. It’s also included many above the poverty line who previously hadn’t been eligible. Google your state insurance commissioner for your specific set of qualifications.

- Medicare: You can qualify for Medicare if you receive Social Security disability benefits or if you’re age 65 or older. Check with the Social Security Administration for your eligibility.

- Consolidated Omnibus Budget Reconciliation Act (COBRA): COBRA is another short-term coverage option. It might be for you if you’ve been laid off or aren’t working. It’s especially appropriate if you had insurance through your former job or otherwise participated in a group health insurance plan. This is great for access but is a more expensive option than the health care marketplace.

- Workers Compensation: If you are being treated for a workplace injury, your state’s workers’ compensation program might have health care solutions for you.

Less Obvious Insurance Options

- Short-Term Health Insurance Coverage: Short-term coverage is available! Think about this if you need to avoid gaps while searching for other options. A simple Google search will point you in the right direction in your state.

- High Deductible Health Plans: A high deductible “emergency” policy is another way to maintain a low-cost health insurance plan. However, it’s akin to making a bet that you won’t get ill. Maintaining a Health Savings Account (HSA) for smaller health issues will probably save you money in the long run.

- Group Insurance from Organization Memberships: If you belong to any kind of membership organization (e.g. an alumni association, professional organization, business bureau, independent worker associations), it’s worth asking if they have a health insurance plan. These also provide reduced health insurance premiums for their members. You don’t have to go the route of employer-provided insurance.

- Group Health Expenses Sharing Plan: These health expenses sharing plan involves a group of people pooling money together to pay each other’s health care costs. They operate a bit like their own insurance company. Members’ pooled contributions are invested and are usually reserved to pay major medical expenses. These plans aren’t typically used for basic day-to-day health costs like checkups or small procedures. Group health expense sharing plans aren’t insurance plans, so they’re not regulated in the same way as insurance. Look into the history of any of these plans before you join one.

- Health Care Sharing Ministries (HCSMs): A health care sharing ministry (HCSM) is another example of a group of people with shared beliefs creating a health expenses sharing plan. An HCSM is a non-profit entity, so again, it’s not health insurance and it’s not regulated in the same way. This alternative to insurance often include provisions that accommodate the beliefs of the group. As a result, procedures (e.g. abortion) that are deemed objectionable would not be covered.

- Health Insurance Discount Cards: These aren’t insurance options but a way of obtaining discounts on medical services. They provide low-cost health services in exchange for a membership fee. They also don’t offer any medical reimbursement but lower your costs when you use the services of members participating in the plan.

These are options. However, the question many of you have remains unaddressed: what if you believe you can’t afford any of these? Well actually you can; some of the above have eligibility based on financial status, such as Medicaid and Medicare. It’s up to you to do the work and discover where you’re eligible.

Furthermore, this is why health prevention is so important. This is why the rest of the health empowerment series focuses on what you can do to swing the pendulum away from waiting to need sick care toward being proactive with preventive and self-care. Stay tuned.

Follow us!

Feel free to ask your SMA expert consultant any questions you may have on this topic. Take the #72HoursChallenge, and join the community. As a thank you, we’re offering you a complimentary 30-day membership at www.72hourslife.com. Just use the code #NoChaser, and yes, it’s ok if you share!

Order your copy of Dr. Sterling’s books There are 72 Hours in a Day: Using Efficiency to Better Enjoy Every Part of Your Life and The 72 Hours in a Day Workbook: The Journey to The 72 Hours Life in 72 Days at Amazon or at www.jeffreysterlingbooks.com. Receive introductory pricing with orders!

Thanks for liking and following Straight, No Chaser! This public service provides a sample of http://www.SterlingMedicalAdvice.com (SMA) and 844-SMA-TALK. Please share our page with your friends on WordPress! Like us on Facebook @ SterlingMedicalAdvice.com! Follow us on Twitter at @asksterlingmd.

Copyright © 2020 · Sterling Initiatives, LLC · Powered by WordPress